Saturday, July 16, 2011

Thursday, July 7, 2011

Dinner & a Movie #6

Listen:

Thursday, June 16, 2011

Dinner and a Movie #4

Tuesday, June 14, 2011

More Decemberists

Decemberists

Dinner and a Movie #3

Thursday, June 2, 2011

Summer Movies, Defending LeBron, and the Top Book of the Last Decade

Wednesday, May 25, 2011

Dinner and a Movie

The Best Possible Video Game

Tuesday, May 24, 2011

The Cars at the 9:30 Club

I took a video of "You Might Think" with the new Droid X. I was a little back and behind a couple tall people, but it's not bad....

Monday, May 16, 2011

High Schooler Challenges Michele Bachmann to Civics Debate

Reuniting Pink Floyd

I've seen a fair number of concerts in my day, but Floyd in '94 (twice) was at or near the top...not because the band was so incredible, but because the songs and the show that went with them were. Watching the band is almost incidental at a Floyd show.

That of course was without Waters, as the band had broken up in the early '80s because, well, because Roger is a godawful pain, that's why. Here's hoping he's mellowed and I can pay much more than I should for a ticket to see 'em all together.

Here's "One of These Days" from the '94 tour. You'll have to trust me, video doesn't do justice at all to the sheer ominousness of the light show and atmosphere.

Saturday, May 14, 2011

Breaking: Focusing on the Deficit in a Recession a Bad Idea

Not very well so far. Britain, which had been in the midst of a decent recovery, saw retail sales drop 6 percent in March. Of course, one month doesn't mean the argument is won, but the problem is that the vast majority of economists knew this would be the result.

Republicans are essentially making the same arguments about what the United States should do. Bring down our deficit now, they say, and financial markets will gain more confidence in our economy, and set interest rates low enough to lead to long-term growth.

Now, there are a few things to say here, all of which should be blindingly obvious but apparently aren't:

- Interest rates are historically low right now. Even in our current state the world has a lot of confidence in the U.S. economy.

- The thing we could do to end this confidence right away is to do something unbelievably stupid like, say, not raising the debt ceiling. That's just what the GOP is threatening to do.

- When a recession is caused by a lack of consumer demand for products, the government steps in to bridge the gap until the economy starts recovering. It's the same formula that's worked time and again since the Great Depression.

Roger Ebert Gets His Voice Back

If you weren't aware, film critic Roger Ebert no longer has a lower jaw, due to complications from salivary cancer and a broken carotid artery. He'll never speak again. But now, emerging technology has pieced together his actual recorded words from his years on television and other sources, and created a computerized voice that, more or less, sounds like him.

It's choppy, but at times you see how far this kind of tool is coming along. This is great because he is one of the best critical writers of his generation, on film or otherwise. Here's Roger at the TED Conference "talking" about his story and demonstrating the new voice. It's worth a look.

How Would You Eliminate the Deficit?

People want spending cuts in the abstract, but rarely in practice, and certainly don't want any tax increases. There are some exceptions (people generally are ok with raising taxes on the wealthy, and it's about 50-50 on cutting national security spending). Point is, people want the deficit eliminated, but they tend to bring down the smack around politicians who come up with a plan to actually do it.

Here's your chance to show you're different. The New York Times has a nifty little app that lets you pick your own deficit reduction plan, and it may be a lot harder than you think.

Here's my plan, which isn't exactly what I would do because the tool doesn't present anything like a complete menu of options. But, it eliminates the deficit with about half spending cuts and half revenue increases, with a lot of room to spare, so that I have some left over to put into infrastructure and R&D investments that will greatly improve long-term growth. Some of these are conditional...for example, capping Medicare growth at GDP + 1 percent would require a powerful Independent Payment Advisory Board like President Obama is proposing, that would have real authority to find significant cost savings.

Any plan you come up with has at least one important quality: it can't be passed by Congress.

We Don't Even Know What to Fix

|

| No, not that Hernando de Soto! |

Enron hid its collapse by moving its losses "off the books" to shell companies to make itself look much more profitable than it was. Today, the financial system seems focused more than anything on making instruments like credit default swaps and complex derivatives that are profitable largely because they are so complicated that it's easy to make money from the people who, at least temporarily, don't understand them.

These activities add almost no value to the economy, but they did do a lot to cause a gigantic recession. Despite all that, the financial reform bill Congress passed last year was modest at best, and even those gains are the target of massive efforts to roll them back.

I don't agree with de Soto that the housing price bubble didn't contribute to the collapse, but he makes a great case that the fact that the modern world just doesn't have much of a clue what's going on in the "shadow banking" system is a huge problem that is likely going to cause another meltdown in the future.

Why We Have a Debt Problem

To follow up on my previous two posts on what changed the equation, Pew Research is out with a short, graphic-heavy paper pinpointing exactly why we're in the mess we're in. The verdict: Just over half was caused by tax cuts and the recession, which made revenues plummet. The rest is a variety of spending increases, led by the wars in Iraq and Afghanistan, and having to pay more interest on the debt because of all the other action we took.

In the graph below, the line on the bottom is what the debt was projected in 2001 to do. The line at the top is what it actually did. Everything in between is why it happened.

Read the piece here.

Good Ideas in Congress You've Never Heard of

Friday, May 13, 2011

Gulleson v. Berg?

Wednesday, May 11, 2011

Obi-Wan Kenobi Dead, Vader Says

CORUSCANT — Obi-Wan Kenobi, the mastermind of some of the most devastating attacks on the Galactic Empire and the most hunted man in the galaxy, was killed in a firefight with Imperial forces near Alderaan, Darth Vader announced on Sunday.

Check the sidebar links too.

Via Jared Keller at the Atlantic.

ADD! THE! TAMARIND!!!!!!

Tuesday, May 10, 2011

Politics for Dinner #2

The Justice League Awaits Word on Bin Laden

h/t Garance Franke-Ruta and Chris Good. Full-sized image here.

Who Knew Michael Bolton Was Funny?

I should note that we already did know that the other Michael Bolton is funny:

Monday, May 9, 2011

Why Health Care Costs So Much in the US

Via: Medical Billing And Coding

I Challenge America to a Staring Contest

Friday, May 6, 2011

Today's Lunchtime Distraction

Rebels and onions got no respect.

Piercing the Star Wars Mystery

Thursday, May 5, 2011

Are Liberals Better Predictors?

That analysis doesn't apply to everyone, though. The most accurate prognosticator of the whole bunch was liberal Nobel Prize-winning economist Paul Krugman, who got almost all his predictions right. These were not generally political forecasts, but economic ones, and he saw the much of what happened with the collapse of the economy earlier, and more clearly, than almost anyone else. He deserves a lot of credit.

On the other end of the spectrum, conservative columnist Cal Thomas is rarely right about much, and that's true almost every year. Anyone in either party who makes such partisan projections is likely to be wrong a lot, and he was.

The full study is here.

Today's Lunchtime Distraction

Roll a D6 from Connor Anderson on Vimeo.

I have to agree with Doctor Science here. How is this not more interesting than the video it parodies?

Wednesday, May 4, 2011

Lunch Break

The Deficit, Part Deux

I appreciate a good debate...

1). The last year that Republicans did a budget was '06 for the '07 year. The deficit in '07 was $167 Billion. The Democrats took the House and Senate in '06. They could raise taxes anytime they wanted after January 1, '09. They didn't, and they failed to do it again in the lame duck session in '10. Do they EVER take responsibility? Taxes affect behavior -- CBO does static analysis. It ALWAYS overstates the revenue from taxes and understates the revenue from cuts.

And what caused the deficit to rise so much after 2007, which was the height of the bubble economy? The chart I posted shows it pretty clearly. We were in a deficit all decade despite not being in a recession. Then, several million people lost their jobs, home prices collapsed, which caused tax revenues to plummet, magnify the visibility of the tax cuts, unpaid-for wars and prescription drug benefits, etc.

Although it is silly to imply that had the Democrats raised taxes in 2007 or 2008 that they ever would have become law, despite what many think, most of them also don't believe in raising taxes in a recession. It's true that they tried to let the top end of the Bush tax cuts expire late last year, but I don't believe that was nearly enough.

It's interesting that you would mention ever taking responsibility, since there has been none from the Republican Party for the many disastrous policy choices and incorrect analyses of the past decade. I used to be a Republican, and supported a number of stupid decisions at one time. But, ultimately my loyalty is to evidence and objective data more than my party, or what I believed growing up. There was no way to keep believing some of what I had since I had been proven so resoundingly wrong.

2). Look at that chart for one second. It is essentially flat! Therefore, taxes are NOT the problem, spending is! See any spending charts that look essentially flat? Nope!

Well, actually you'll notice that right now taxes are about 15 percent of GDP, and they perhaps average 17.5 percent since the '50s (sometimes over 20 percent). But let's be generous and say it's only a 2.5 percent difference. Given that GDP in 2009 was $14.12 trillion, that's about $350 billion a year difference, or $3.5 trillion over 10 years. To put that into perspective, the House Republican plan says it would cut $4.4 trillion over 10 years. The Fiscal Commission is at $3.9 trillion, while President Obama's is $4 trillion. It's the same ballpark.

Even if that were not the case, the logic here doesn't follow at all. The deficit is simply revenues minus spending. Neither is inherently the problem. Any real solution is going to have to include both. Spending is a problem if it's going to waste. Be specific, and on something that actually adds up to a significant number.

Finally, the main point I was making with point #2 is that the President has not raised taxes, but in fact lowered them. This is not common knowledge. Perhaps I could have been clearer.

3). Oh, be serious! The budget shot up from $2.8T to $3.8T and the deficit shot up from $167B to $1.6T. It really makes no difference at all what you want to try to label it, it is SPENDING!!! This dodge is exactly like me putting on 10lbs and trying to call it muscle mass!

Your point here essentially boils down to, "oh, come on!" My point is that the vast majority of the spending increases would have happened under a Republican or a Democratic president because they were automatic. It is not because President Obama went on a binge, and you don't engage the point other than yelling, "spending bad!"

4).OK, and is this new? The US defense total budget is $800B. Cut it in half and you don't even get the current deficit under a T. Cut it all and we are still running $700-$800 B. THE PROBLEM IS ENTITLEMENTS!!!

Cut it in half and you get to $4 trillion over 10 years, which again is what the main parties' plans are roughly trying to cut from the deficit. If you want to contend that's nothing, be my guest.

Why do you feel the need to make this a binary debate? The problem is not a single thing; that's true in much of life, and it is much more so with a complex subject like this. There are many, many causes, and a reasonable solution is going to require multiple pieces. This is both a huge piece of it, and as one of the most wasteful areas of government spending, something conservatives should want to attack with ferocity if they believe their own rhetoric.

5). Transfer payments to individuals -- FICA, Medicare, Food Stamps, Unemployment, Farm Programs, etc are $2.2 Trillion. We are buying votes with over half our budget. 80% of the people receiving those payments are not "needy". Most are better off than the youngest quartile of the population. Quit stealing from current and future children and buying votes from greedy geezers!

I agree with you that a lot of farm subsidies make no sense, and also that the interest groups who get Social Security and Medicare, etc., strongly resist any change in benefits, and that's a problem. I am for cutting a lot of subsidies and means testing Social Security in some fashion.

However, to contend that votes are bought with food stamps and unemployment...well, if they are, it's an extraordinarily inefficient way to do it, because the voting percentages there are much lower.

Statistically, aid to poor people in a recession is one of the most economically beneficial things that can be done. It is almost all spent, and spent quickly, which is just what a demand recession like this one needs to be stabilized and reversed.

I hope we can also agree that the worst subsidies we have are the ones that go to the richest people, such as to oil companies, and mortgage interest deductions for mansions, for example. What is the benefit of these policies?

Here's perhaps the central problem: Americans want big spending cuts, except that they don't actually want to cut specific programs. Also, they don't want to pay for the programs they don't want to cut. There is a lack of leadership in Washington, true, but to a large extent, we are getting the government we deserve because we turn on politicians who try to actually solve the problem.

6). OK, and this is news??? Helloooo ... and where were you decades ago when this was clear? Expecting Boomer mass suicide or something?

Saying the same thing I am now...what that I've said gives you another idea? Everybody knew this was coming, but it was easier to kick the can down the road. Both parties are guilty of this.

7). Not financially. Earmarks are "leverage" in the overall corruption of using one group of people and future generations as coerced campaign donors to buy votes. They are political credit default swaps.

A separate argument that one can make. For the purposes of this discussion, though, my point is to let people know that they are not relevant to the deficit debate.

8). Liberal "facts" are all about "projections". Look at the "actuals" .... pretty flat. Look at the big bump in "near in projections" 10-12. Look at FICA / other non-interest ... again, flat. THEREFORE, what this is about is Democrat ASSUMPTIONS / PROJECTIONS about the future. Is anyone surprised that they at least claim to believe that their policies work?

Look at their track record -- when Democrats instituted Medicare in '65, they said it would cost $9B in 1990 -- in fact it cost $67B http://www.usatoday.com/news/opinion/editorials/2005-02-09-edit_x.htm

And conservatives opposed the Civil Rights movement in 1965 too. How relevant is this today? We have a lot more recent examples we can point to, such as predicting that the Iraq War would cost $50-60 billion (actual so far perhaps $1-3 trillion), that the 2001 tax cuts would create massive numbers of new jobs and still pay off the deficit (actually was one of the worst economic decades in US history and ran large deficits), or really almost any prediction the previous administration made on any controversial issue.

Second, the CBO is not "liberal". They are non-partisan. Their numbers are not perfect, but neither can anyone else's be, since predicting such things is incredibly complicated. But, their predictions hold up immensely better than any conservative think tank you can point to on a regular basis.

Finally, as with Social Security, one of the main reasons Medicare cost more than expected is that the program was expanded to cover a lot more things than it originally did. The comparison isn't apples to apples.

9). OK, so what IS it like? Infinity? It is a WHOLE lot more like your family budget than it is like infinity -- it is much larger than your family budget, but it is limited like your family budget just the same. If government spending created wealth, every nation on earth would be filthy rich. The government IS a HUGE family budget, and our US family is way bankrupt from exactly the kind of fuzzy thinking in #9.

I don't even know where to start with this. The concept is counter-cyclicality. We decrease our budgets when we have tougher economic times. The government increases theirs to smooth out these conditions. The whole point of the safety net is to run counter to consumers' budgets when there's a recession. It's one of the main reasons we haven't had another Great Depression since we had the original.

Second, the idea that government spending doesn't create wealth is insipid. In some cases it doesn't, such as transfer payments, buying bullets for the army, or paying interest on the debt. In other cases there is no question that it does, such as when the Defense Department is creating the Internet, sending soldiers to college through the G.I. Bill, or building mass transit systems that drastically improve the business environment in cities. Again, you make this into a binary...some spending is good, some is bad. Some is wasted, some creates enormous wealth for the rest of the country, and funds things the private sector would never do on its own. And everything in between.

Our problem is not so much spending, as that we spend on some dumb things, and we won't pay for the things that we do want.

10). Continuing to pile on more debt will certainly be catastrophic. Stopping our debt addiction will only be catastrophic if the current administration plays suicide roulette. As long as we pay the interest on the debt and any redemptions, there is no default. The interest is around $400 B, but will rocket shortly if we don't quit borrowing since we need to jack interest rates to fight inflation or simply to inscent purchasers to buy debt from a bankrupt nation. All our debt is short term -- interest doubles and the payment is $800 Billion. The BEST way to prevent that from happening is to STOP BORROWING!!! It may be the only way left to somewhat save ourselves from ourselves.

Our revenues are just north of $2T per year. That means that we could stop borrowing, pay the interest on the debt, and still have $1.6 Trillion and change to spend. Say $500B for defense and a Trillion for everything else.

This is just not how the market works. The reason we are able to borrow so easily now and pay such incredibly low rates on it is because nearly everyone else around the world thinks there's no way we'll default or not be able to overcome this disagreement. They may very well be wrong. If we don't raise the ceiling, those assumptions collapse, and exactly what you're trying to prevent - interest rates going up in the long term - go up immediately.

If you're pushing for just immediately cutting back to a balanced budget, that's one thing to argue in theory, but neither Republicans nor Democrats are going to get anywhere near passing anything that would do that (yes, even with the amendment that Republican senators have supported, some presumably because they know it has no chance to pass and so it has no downside, and others because they're economically illiterate).

I go back to the countercyclical point above. I have been a deficit hawk for many years, long before it became the popular issue of a party looking to shift blame for its disastrous policies onto the other party. Cutting spending with 9 percent unemployment makes no sense.

Tuesday, May 3, 2011

Politics for Dinner

We're talking about making this a weekly thing, so I hope y'all like it.

Lunch Break Pets

Monday, May 2, 2011

Sci-Fi Ideas Come Mostly From Yugoslavia

|

| This is where they got the idea for the Cylon Raider, right? |

Sunday, May 1, 2011

Francis Farewell Starlite

Maybe my favorite song on the album is "Tap the Phone," though. Here's a spare, riveting version I think he just played impromptu for someone who was photographing him last year.

NFL Draft Recap Show

Thursday, April 28, 2011

Wednesday, April 27, 2011

10 Things You Need to Know About the Deficit

- About half the deficit is because of the recession and Bush tax cuts. High unemployment means fewer people paying taxes, and the tax cuts mean they pay less when they do have jobs. We can argue whether that's fair or not, but the numbers are what they are.

(Income tax cuts do not increase net revenues except in extreme cases where, say, marginal rates are something on the order of 80-90 percent. Our top bracket is at 35 percent.)

The chart at right from CBPP breaks down the rest. Our wars in Afghanistan and Iraq are significant contributors, and the past couple years the stimulus factored in too. However, most economists, including conservative ones, agree that the stimulus saved a whole lot of jobs, which made a potentially disastrous situation just really bad.

- Taxes are at their lowest effective rates since 1950. We can disagree about what percentage of deficit reduction should come from tax increases rather than spending cuts, but we paid on average the lowest rates since 1950, and the big tax-cut package signed last December should decrease them further. Via Felix Salmon's blog:

- There has not been a massive spending binge under President Obama. Aside from the stimulus, Obama has ordered pay freezes and cuts to numerous programs. Refer back to point #1.

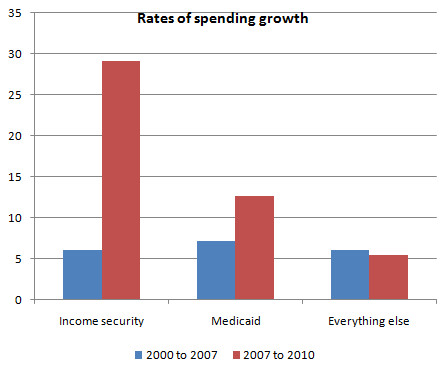

There has been a big rise in spending in one major area, though: safety net programs. This is spending that automatically kicks in during a recession, to pay for things like unemployment insurance, food stamps and Medicaid. Here's a good graph from Paul Krugman mapping it out (full article here). Note that spending on the kinds of things that don't rise automatically has gone up at a slower rate than under President Bush.

- The U.S. is responsible for almost half of the world's entire defense budget. Yes, we spend as much as almost every other country combined, and most of the next-biggest budgets belong to our allies. All this is the case despite there being little dispute that there is massive waste at the Pentagon, and there doesn't seem to be a coherent argument about why the budget level we have now is the right one, and why. Via Matt Yglesias:

You can also see a breakdown by country here.

- The few things everybody wants to cut are a tiny fraction of the budget. Americans are in favor of massive spending cuts in the abstract, just not in specifics. The popular impression seems to be that if only we didn't give money to foreign countries, NPR and lazy poor people, our problems would be solved. The reality is not close.

When you take out Medicare, Social Security, defense and interest payments on the debt, you're left with only about 15 percent of the budget. This includes a wide variety of categories: veterans benefits, agriculture programs, energy, education, transportation, social services, housing, the justice system, scientific research, environmental protection...the vast majority of the programs this chunk of the budget supports are some of the most popular things government does.

You can see a nice pie chart here.

- Our long-term entitlement problems are mostly because Boomers are retiring. The Boomer generation is the rabbit that's just been swallowed by the snake. All those workers are still pumping tax money into Social Security and Medicare, but as more reach retirement age, a smaller group of younger workers will be supporting their benefits. As the Economist reports, over the next 20 years, the share of the U.S. voting-age population over age 65 is expected to jump from 17 to 26 percent.

- Earmarks are not the problem. Earmarks accounted last year for less than 1 percent of the federal budget. It's not just that they're small potatoes, though. Earmarks don't actually even increase federal spending. They take the existing budget and rope off a certain portion for projects that Members of Congress think are the most important for their districts.

Whether they are wasteful or not is a separate argument...some clearly are, but not nearly as many as you think. The point here is that they were not the cause of the deficit crisis.

- It's about health care costs, not Medicare costs. This is a really important distinction. When we talk about entitlement reform, we look at how much Medicare is expected to cost us in the future and it's not pretty. But, it's not because Medicare costs so much, because in fact Medicare costs a lot less than private insurance for the same coverage. It's because health care costs so much.

Paul Ryan's budget proposes to solve the deficit in large part by privatizing Medicare by giving people vouchers to purchase coverage on the open market. This does nothing to stop the cost of health care from rising, though. It just puts the responsibility for keeping up with costs into each individual's hands, and gets rid of the central premise of Medicare: insurance. The plan would shrink government spending, but would increase overall spending by a great deal more than it cuts. This is hiding the problem and making it worse.

In contrast, the Affordable Care Act ("Obamacare") is projected by the Congressional Budget Office to cut the deficit by $143 billion over 10 years, making would make it the most effective deficit reduction legislation since the 1993 Budget Act. It should be noted that those projections assume no cost savings from a number of the pilot programs in the ACA, so there is plenty of potential upside to those figures.

Here's a nice chart Ezra Klein has used a few times before, but bears reposting. The left-hand axis shows spending as a percentage of GDP. It's about health care.

- The federal budget isn't like a household budget. It's tempting and understandable to make the argument that during an economic downturn, households have to tighten their belts, so the government should too. It's just common sense.

- Not raising the debt ceiling would be catastrophic. Follow me here: The argument against raising the debt ceiling, besides what is implicit in #8, is that our deficit spending will cause a crisis of confidence in the American economy. In the long run, this is probably true. However, nothing could undermine confidence in our economy faster than not our political system not being able to solve what should be a simple and obvious problem.

Short version: The rest of the world considers U.S. bonds to be the safest place to park money, making it extremely cheap for us to borrow. That, and the U.S. dollar's position as the world's default currency, could disappear overnight.

Ezra Klein says it best, as he often does:

To understand the danger posed by the debt ceiling, it helps to understand the financial crisis. A lot of banks and investors held assets based on mortgages they thought were safe. They weren’t. That meant that no one knew how much money they really had, or how much money anyone else really had. So the market did what woodland creatures do when they get confused and scared: It froze. And so, too, did the economy. As the unemployment rate shows, we’re still not completely thawed out.

If Congress fails to lift the debt ceiling beyond its current limit of $14.29 trillion — or even waits too long — the chain of events will be similar, but the asset under question will be America itself, not some newfangled Frankenstein bond made out of mortgages from the Reno suburbs. Which would mean the aftermath would be much, much worse.

“The cornerstone of the global financial system is that the United States will make good on its debt payments,” says Mark Zandi, chief economist at Moody’s Analytics. “If we don’t, we’ve just knocked out the cornerstone, and the system will collapse into turmoil.”

We are playing with fire right now, and if we aren't careful, we're in for a financial nightmare.

And it's exactly wrong. One of the major roles of the federal government is to be anti-cyclical. That is, a recession is the time when people are most in need of government programs to let the unemployed keep feeding their families and off the streets. The federal government should run deficits during recessions, and probably surpluses during good times. (Incidentally, this is why a cap on spending as a percentage of GDP is such a terrible idea.)

The problem with the current recession isn't that there isn't enough money available for people to go out and start businesses. It's that there isn't enough demand for the things businesses make and the services they provide. Businesses in many sectors have been hoarding profits for quite a while, waiting for demand to pick back up. That's why most of the tax cuts we've passed during the recession haven't been too effective, and a lot less effective than spending on infrastructure and aid to the poor. The former builds long-term economic growth, and the latter gets immediately injected back into the economy.

If you made it all the way through, I'm impressed. I'd also like to hear what you think. Anything I should've included? What's your path to an eventual balanced budget? Comment away...

Update: Added several links and charts for clarity and further information, and made a few layout corrections.